Kelly Criterion in Sports Betting: What Is It and How to Apply It Correctly?

When it comes to bankroll management in sports betting, one of the most well-known and discussed methods is the Kelly Criterion . This formula, developed in 1956 by John L. Kelly Jr., is considered by many to be one of the most effective ways to maximize long-term bankroll growth while minimizing the risk of ruin.

But how does the Kelly Criterion actually work? Is it applicable in the real world of sports betting? And what risks does it pose if it’s misinterpreted or misapplied?

In this article, we explain it to you step by step and with practical examples.

What is the Kelly Criterion?

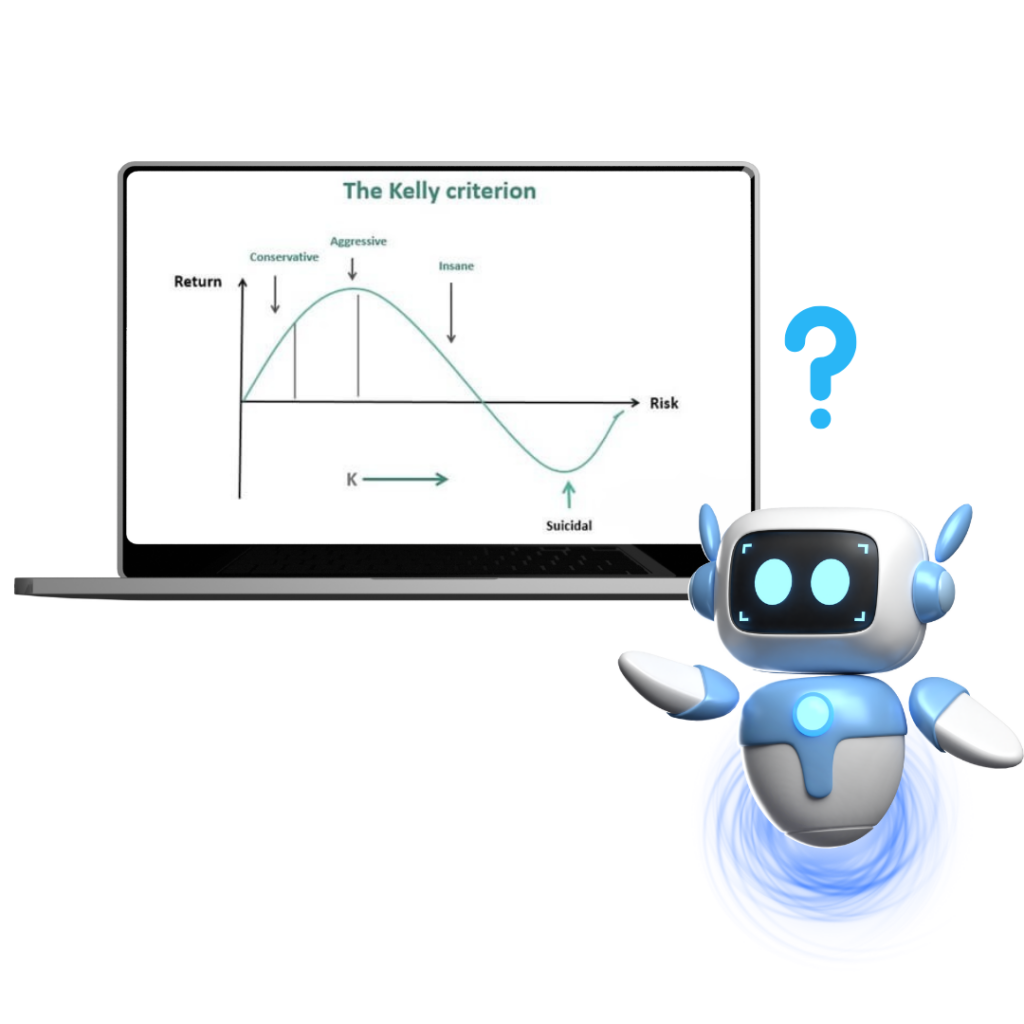

The Kelly Criterion is a mathematical tool designed to help you manage your capital optimally when betting on sports . Unlike more intuitive or emotional methods—such as betting fixed amounts or raising the bet after a win—this strategy is based on a logical and very powerful principle: adjusting your bet size based on the expected value of each opportunity.

Essentially, the criterion tells you that you should bet more when you detect clear value in a given odds—that is, when the implied odds offered by the bookmaker are lower than the actual odds you estimate . And conversely, when there’s no value, you should bet less or not at all. This logic allows you to maximize the growth of your bankroll over the long term while limiting the risk of ruin.

This simple but powerful idea transforms the way you approach every bet. It’s no longer a question of whether you “believe” a team will win, but rather whether that outcome is undervalued by the current odds. And if so, the Kelly Criterion helps you decide how much you should invest in that bet to obtain the maximum possible profit over time.

⚠️👉 If you’re not a math geek and you’re just here to see how to maximize your earnings with sports betting…

↓↓↓ You can skip the following section in gray and continue further down! ↓↓↓

The Kelly Criterion Formula

The original formula is as follows:

f = (bp – q) / b

Where:

- f = optimal fraction of your bankroll to bet

- b = decimal odds minus 1 (i.e. net profit per unit bet)

- p = estimated probability of winning the bet

q = 1 – p (probability of the bet losing)

Practical Example of the Kelly Criterion

Imagine you find a bet with odds of 2.50 (i.e., you would win 1.5 net units for each unit bet), and you calculate that it has a 50% real probability of happening.

We apply the formula:

f = (1.5 × 0.5 – 0.5) / 1.5

f = (0.75 – 0.5) / 1.5

f = 0.25 / 1.5

f = 0.1667

Result: According to the Kelly criterion, you should bet 16.67% of your bankroll on this bet.

This may seem like a lot, and that’s where we get into the debate about the full version vs. the split version of the criterion.

Fractional Kelly: A More Stable Alternative

Many practitioners use what is known as fractional Kelly : applying only a portion of the result given by the formula (e.g., half or a quarter ).

Following the previous example, instead of betting 16.67% of your bankroll, you would use half (8.33%) or even less. This reduces volatility and allows for more comfortable emotional management.

How Does Kelly Relate to Value Betting?

The Kelly Criterion only makes sense if you are making true value bets , that is, when the probability you assign is greater than what the odds suggest.

If you bet without a clear and realistic estimate of the probability, Kelly is useless and can even be dangerous. Therefore, it’s a more useful method for traders, modelers, or users of automated tools like BetOven , where value bets are detected based on objective odds comparisons.

Is It Always Smart to Bet, According to Kelly?

Not necessarily. Although mathematically it’s a long-term optimal formula, there are several reasons why applying the Kelly Criterion in its full form in the real world isn’t recommended:

- Odds are not exact: you are estimating the probability of an event, and any error can cause you to bet more.

- High volatility: Betting 10%, 20%, or more of your bankroll on a single bet can lead to huge losing streaks.

- Bookmakers limit winners: Betting aggressively can attract bookmakers’ attention more quickly.

The emotional factor: Negative streaks can make you doubt your method and make irrational decisions.

The million-dollar question: Does doing these manual calculations make you more of a WINNER or more of a TRAP?

Yes, calculating and overcalculating all these strategies and using tools like the Kelly Criterion can be great and make you feel like a real pro…

But is it really necessary to rack your brains over complex formulas when you can simply give an input to an artificial intelligence that performs calculations in milliseconds and finds opportunities that a human would be unable to spot?

Put aside your ego, embrace efficiency, and simply start using BetOven’s AI.

The smart way to win long-term is by using software that performs 100% automated sports arbitrage : To effectively exploit these errors, you need software that analyzes thousands of odds in real time and automatically detects where profitable opportunities lie.

BetOven does just that: it scans bookmakers in milliseconds, identifies incorrectly adjusted odds, and allows you to take advantage of them before they’re corrected. Thanks to this automation, you can maximize your profits without relying on limited statistical models or inefficient manual calculations.

Can Kelly be used with software like BetOven?

Yes, but be careful. In systems like BetOven, which detect real value bets, it can make sense to use Kelly as a reference to set the stake proportional to the value . However, it’s not recommended to use the full Kelly, but rather a fraction of it , especially if you’re just starting out.

Keep in mind that BetOven’s ability is precisely to detect the errors that live bookmakers make when formulating their odds and automatically bet on them. This would already meet Kelly’s objective without even having to perform manual calculations.

A good practice is to use more conservative settings at first and adapt them as you better understand your risk tolerance and system behavior.

We recommend that you follow the parameter configuration tips in the BetOven setup video, which you’ll find when you try the software completely free. To do so, just click below.

The Kelly Criterion is a powerful mathematical tool for maximizing bankroll growth, as long as it is used intelligently and with caution.

- It’s not for everyone.

- It depends on realistic estimates of probabilities.

- And it must be accompanied by a solid and stable risk strategy.

In the world of sports betting, the long term is the real playing field . Combine good bankroll management, real value bets, and, if you wish, a responsible implementation of the Kelly Criterion.

Now, if you really want to win…

Stop manual betting... Maximize your profits by trying AI for free.

BetOven is the number 1 automated sports arbitrage software, specifically designed to automate the betting process while ensuring we maximize our profits , both in surebets and valuebets. It’s such a powerful tool that it’s able to detect errors that live bookmakers make when formulating their odds and automatically bet on them.

In the following video, you can see how BetOven’s AI works and how you can try it for free to maximize your sports betting profits:

The Best Free Training

If you would also like to learn more about the world of sports arbitrage to maximise your winnings? You will have access to the best Artificial Intelligence Sports Betting Course!

In this training, you’ll learn how to perform automated sports betting trading with the support of the innovative artificial intelligence software BetOven, a tool designed to simplify and optimize your strategy, allowing you to delegate the complex work while maximizing your results.

✔️ 100% Results-Oriented: Designed to help you maximize your profits from day one.

✔️ 100 Free: Learn at no cost and access premium-quality content.

✔️ For All Levels: From beginners to experts, our content adapts to your needs.